Historically speaking, small businesses have played a critical role in supporting the growth of the United States. While the American economy thrives on a combination of both small and large businesses, due to their crucial role in job creation, innovation, and community impact, small businesses can indeed be considered the bloodline of America.

Small businesses have been and will continue to be essential for the country’s economic health and social fabric. This article aims to present a few simple truths that accurately describe one of the crucial problems facing small business owners and how they can turn those problems into opportunities.

Let’s start with a few simple truths:

1. Based on data collected in July 2024, accountants and bookkeepers support approximately 23.2 million small businesses in the United States actively using QuickBooks.

2. Those 23.2 million small businesses will likely have an accountant file their taxes yearly.

3. Every single data point recorded inside every one of those 23.2 million QuickBooks accounts is based on transactions that were transacted exclusively in the past.

Besides CPAs and bookkeepers, no small business owner ever started their small business because of their love for accounting. Since most business owners have no formal accounting training, they avoid looking at their financial data, making it harder for them to feel good about their finances.

As a result, today’s small business owners get almost zero cash flow education from the accounting industry and have relatively no idea what their actual financial data or cash flow looks like. In terms of accounting, small business owners all over the country are left with no choice but to “drive” their company forward using only a rearview mirror.

A rearview mirror is a very good tool for looking backward, but, in business, if we want to arrive at our chosen destination aka achieve our personal and professional goals, adding a GPS improves the quality of the journey and creates a more attractive destination. Having the guidance and the security of being on the right path reduces any bumps in the road along the way.

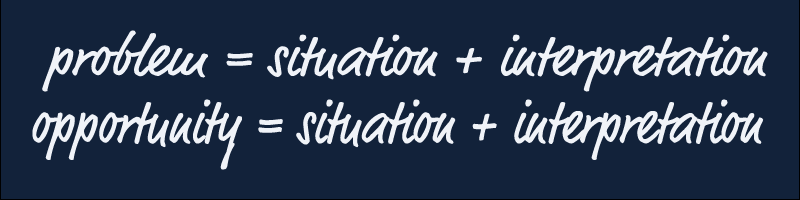

A problem can be defined as a situation plus interpretation. At the same time, an opportunity can also be defined as a situation plus interpretation. Let’s reframe this systematic accounting problem and discuss the opportunity buried under the surface.

A New Opportunity:

If you’re familiar with the sleepless nights that come with not having enough money in the bank account to cover payroll, you know how stressful cash flow management can be when it doesn’t go well. In business, one of the most effective ways to reduce stress and improve mental clarity is to first gain financial clarity.

Having accurate financial data in real-time promotes mental clarity for owners, executives, salespeople, and even household leaders. Proper cash flow management allows for a more strategic approach to making decisions. Better still, proper cash flow management means seeing ahead of the curve and achieving better results down the road.

The trick for most business owners is that they have nowhere to turn to for proactive forecasting and cash flow discussions. The massive exodus of active CPAs is creating a deficit in advisory services, and busy bookkeepers are overworked and not trained to manage cash flow.

Built with the business owner in mind, Accounted4’s accounting-based technology provides accurate financial data in real-time and virtual business coaches who guide owners using data-backed trends and forecasting. Every day, Accounted4 clients are creating and executing strategies related to growth, savings, and owner’s compensation.

If you’re a small business owner who uses QuickBooks and you want to learn more about cash flow management and the story your financial data tells, take advantage of Accounted4’s free QuickBooks assessment. Click here to see what Accounted4 clients are saying and sign up to learn how to receive a free QuickBooks assessment.